Pre-selling real estate is a marketing strategy that developers use to sell properties before construction is complete. This method has gained popularity in recent years, as it provides benefits for both developers and buyers. Developers can generate early cash flow, while buyers can get a lower price and have more input on the design and features of their future home.

The process of pre-selling typically involves developers marketing their project, often through brochures, websites, and sales centers, to potential buyers. Buyers are offered the opportunity to reserve a unit in the development by making a deposit, which is often around 10% of the total purchase price. Once construction is complete, the buyer can then proceed with the purchase, paying the remaining balance.

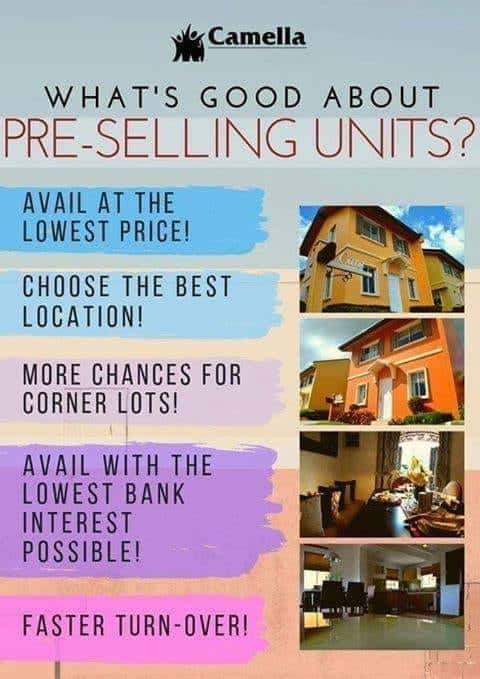

One of the primary benefits of pre-selling is the potential for lower prices. Developers often offer discounted prices during the pre-selling phase to attract early buyers. As construction progresses, prices may increase as demand for the units grows. By purchasing early, buyers can take advantage of these lower prices and potentially see a significant return on their investment when the property is completed.

Additionally, pre-selling allows buyers to have more input on the design and features of their future home. During the pre-selling phase, developers often allow buyers to customize their units, selecting finishes, layouts, and even adding certain features. This level of personalization is often not available for properties that have already been completed.

For developers, pre-selling can provide early cash flow, which can help fund the construction of the development. Developers can also use pre-selling to gauge interest in the project and make adjustments to the design or pricing accordingly. By having a certain number of units pre-sold, developers can also secure financing more easily, as banks are more likely to lend to projects that have already generated interest from buyers.

However, pre-selling also comes with its risks. Buyers must be willing to put down a deposit on a property that has yet to be completed, which can be daunting for some. There is also the risk of the development not being completed or encountering delays, which can leave buyers without a home or with unexpected costs.

In conclusion, pre-selling real estate can be a beneficial strategy for both developers and buyers. Developers can generate early cash flow and gauge interest in their projects, while buyers can take advantage of lower prices and have more input on the design of their future home. However, buyers should carefully consider the risks and weigh them against the potential benefits before making a decision.

pre selling real estate If you are an aspiring home buyer who is actively searching for properties for sale in listing websites, or if you are actively on the rounds attending open houses, you have probably encountered the word preselling at some point. What is a preselling property and what are its advantages?

For more information: call or text

Giovanni Carlo P Bagayas Globe 0916-336-35-18 and Smart 0949-919-05-45 😊

for Faster transactions

Why Philippine Pre-Selling Properties Have An Advantage…

Perhaps some of you property buyers and investors are asking… Why are Philippine Pre-Selling Properties better than the rest, like secondary properties or foreclosed properties? Here’s why:

Philippine Pre-Selling Properties usually have a NO DOWNPAYMENT and NO LUMPSUM payment term, meaning you just have to shell out about P8,000 plus a month, and you can already own a quality 20sqm studio!

A Philippine Pre-Selling Property usually appreciates as time goes by and as the construction gets nearer and nearer to its completion time, by as much as 100% or DOUBLE (no kidding!)

Even though many Philippine Pre-Selling Properties are delayed in construction by about 3 months or so, the profit you will gain by the sheer appreciation of the property will cover for that minimum time loss!

You just have to learn to select a QUALITY developer who has the LEAST number of delayed projects, as evidenced by their history of projects made

(HINT: Many pre-selling properties have delays in construction because of its usually the Contractor’s fault, not the developer)

These advantages are already good enough for you to invest your hard-earned money into a Philippine Pre-Selling Property, aren’t they? 🙂

pre selling real estate How to Choose: PRE-SELLING vs FORECLOSED vs SECONDARY PROPERTIES

When one wants to invest in a Philippine Property, (or any property for that matter), the careful buyer will always find three types of properties to choose from by canvassing around: Pre-selling, Foreclosed, and Secondary Properties.

Given a budget to work with, whether it’s a million-peso figure and/or a monthly budget based on your income, how will you know which of the three suits you best?

Aside from the location of the property itself which of course is crucial to you depending on where you live and work, allow me to give you this chart below so you will know what to expect on each of the three: (All Caps means an ADVANTAGE)

| Pre-Selling | Foreclosed | Secondary | |

| Quality | BRAND NEW | Usually Plenty of repairs to be done | May have minimal or many repairs |

| Availability of Use | 1 to 5 years, depending on type of property and developer reputation | After Repairs (unless it needs none which is very very rare) | MOST READY due to minimal repairs |

| Price per Sqm | Lower than Units Ready for Use | LOWEST and CHEAPEST | Brand New = Expensive. Older = Cheaper |

| Payment Terms | BEST – Very flexible depending on buyer’s capabilities = Either High down and Low Monthly, or Low Down High Monthly (sometimes even NO DOWN) | Good = Usually 10 – 20 % down and the rest of the balance in bank loan for Monthly’s = Low Down, High Monthly’s | Mostly Cash or Bank Loan of 50 to 70%, which means Down of 30 – 50% = High Down, Lower Monthly’s |

| Best Traits | BRAND NEW, BEST TERMS | CHEAPEST, can do RENT-TO-OWN | READINESS for USE |

| Worst Traits | Have to Wait before using it | Tons of Repairs, time needed | Sometimes Expensive, rigidness of Payment Terms |

I believe this chart speaks for itself and is very very helpful especially to the newcomers in the Real Estate Philippines Industry.

Now you know what you getting into when it comes to real estate investing. Feel free to bookmark this link for your continued reference and give it out to your friends and relatives who are looking for a property, whether for their own use of for investment.

Now, if a Philippine Pre-Selling property suits you the best, check our Camella homes pagadian city courtyards

If you are looking for a Foreclosed Philippine Property, you can check the banks for their listings by going there at their branches, looking at the newspapers, calling them up, or checking their websites.

And lastly, if you are looking for a Secondary Property, you may look at the classified ads (especially the Manila Bulletin), check the internet, or ask your Philippine Real Estate Brokers and friends who may have such up for sale.

Happy Property Hunting to all!

pre selling real estate people ask

What is pre selling in real estate?

In real estate, a pre-selling condo is a condo being sold before its completion, during its construction, or while still in the planning stages. These mean that the property still does not exist and the developer is yet to break ground for the project.

pre selling meaning

Pre-selling is a marketing technique that has become increasingly popular in recent years. It involves creating anticipation and generating interest for a product or service that is not yet available for purchase. This can be done through various means such as social media campaigns, email marketing, or even word-of-mouth.

The goal of pre-selling is to build hype and excitement around a product or service before it is even released, thereby increasing the chances of a successful launch. By creating a sense of urgency and exclusivity, pre-selling can encourage potential customers to make a purchase when the product or service is finally available.

Pre-selling is especially useful for startups and small businesses who may not have the budget or resources for traditional advertising campaigns. It allows them to generate buzz and attract attention without the need for a large advertising budget.

Another advantage of pre-selling is that it can help businesses gauge demand for their product or service before it is released. By offering pre-orders or sign-ups, businesses can get a better idea of how many people are interested in their product, allowing them to adjust their production or marketing strategies accordingly.

Pre-selling can also create a sense of community and loyalty among early adopters. By giving them early access to a product or service, businesses can make them feel like they are part of an exclusive group. This can lead to positive word-of-mouth and referrals, which can be invaluable for a business’s growth.

However, pre-selling also comes with some risks. If the product or service does not live up to the hype, it can lead to disappointment and negative reviews. This can be particularly damaging for small businesses who rely heavily on word-of-mouth and customer reviews.

To mitigate this risk, it is important for businesses to be transparent about their pre-selling strategies and to communicate clearly with their customers. They should be upfront about the expected release date and any potential delays or changes to the product or service. Additionally, businesses should ensure that they have the resources and capacity to deliver on their promises before launching a pre-selling campaign.

In conclusion, pre-selling can be a highly effective marketing strategy for businesses looking to generate buzz and build excitement around their products or services. However, it is important for businesses to approach pre-selling with caution and to communicate clearly with their customers to avoid disappointment and negative reviews. With the right approach, pre-selling can be a valuable tool for businesses of all sizes to drive growth and success.

Giovanni Carlo P. Bagayas is a seasoned travel guide and passionate explorer from the Philippines. With years of experience uncovering the hidden gems of his homeland, Giovanni has dedicated his career to showcasing the beauty, culture, and adventure that the Philippines has to offer. As the author of Best Philippines Travel Guide, he combines his expertise and love for travel to provide insightful tips, detailed itineraries, and captivating stories for travelers seeking unforgettable experiences in the Philippines. Giovanni’s mission is to inspire wanderlust and help visitors discover the true essence of his vibrant country.

Pingback: real estate financing terms and Unlock What They Mean 2020

Pingback: The Philippines' Investment Grade Status and It's Effect on our Real Estate | Listio.org